Current and Future Conditions Affecting Ontario’s Natural Gas Market

Most major natural gas producers and marketers have entire departments dedicated exclusively to seeking a competitive edge by finding or interpreting news, weather, and industry data to anticipate price movements. And yet, market outlooks shift in real time and market volatility abounds.

– Cory Slinger, Director, Business Development, Jupiter Energy Advisors Inc.

As we’ve witnessed in recent years, several circumstances and real-time fluctuations can quickly cause uncertainty, impacting the price and volatility of the natural gas market. These include:

- Extreme weather conditions, which are likely to increase due to climate change;

- Global events like the COVID-19 pandemic and the wars in Ukraine and Israel;

- Increasing global demand for natural gas; and

- Government environmental policies such as the Federal Carbon Fuel Charge, among others.

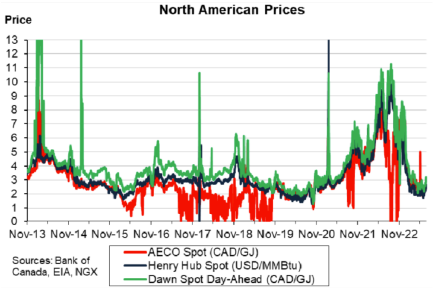

In 2021 and 2022, natural gas prices experienced a period of high volatility, caused by several factors including the COVID-19 pandemic and the effect that the war in Ukraine has had on global demand for North American gas exports such as liquified natural gas (LNG).

We’ve also seen the impact that weather and climate change can have on the price of natural gas. In 2022/2023, both North America and Europe experienced milder winters which saw the price of natural gas return to more moderate levels as demand lowered due to people having to heat their homes less. However, the increasing incidence of significant climate change events – including extreme temperatures, wildfires and flooding – extreme weather as well as the growing importance of global demand for LNG will add continued uncertainty to North American natural gas prices while putting a focus on the pace of energy transition.

Both the Canadian and American governments have implemented environmental policies that will have a major impact on both the exploration/production and consumption of natural gas as fossil fuel-based electricity is phased out. In Canada, the Federal Carbon Fuel Charge will continue to increase annually up to April 1, 2030, increasing the cost of purchasing natural gas.

In the short-to-medium terms, I think we can expect continued volatility and potentially high prices on the natural gas marketplace.

– Steve Schmidt, Vice President, Sales and Marketing, VIP Energy Services Inc.

With continued market uncertainty, increasing costs, and the climate impact of natural gas, organizations may need to consider reducing their use of natural gas and transitioning to more sustainable energy sources.

Return to Industry Spotlight: Focus on Natural Gas Management