Navigating Supply Chain Challenges with Insights from OECM’s Supplier Partners

Global supply chains across industries are buckling under the pressure of unprecedented demands, continued labour shortages, facility closures, and drastic increases in the cost of raw materials, fuel, transportation, and more. Procurement professionals can’t turn a corner today without feeling the pinch or hearing about the severe impact of the COVID-19 pandemic (among other global disruptions) on the supply chain.

As the trusted collaborative strategic sourcing partner for Ontario’s Public Sector, OECM’s focus is on finding the best solutions to help our customers, by minimizing costs, where possible, and generating savings and efficiencies on products and services available through our Marketplace. We understand that these are concerning issues, so it’s important that we work closely with our partners to unpack the complexities of an impacted supply chain.

Introducing OECM’s Industry Spotlight

Through this quarterly Industry Spotlight news resource, we’ll share the information our Supplier Relationship Management (SRM) teams have gathered and analyzed, including up-to-date specifics on the various setbacks that supplier partners are navigating, how the pandemic continues to impact their industries, as well as examples of the supply chain upheaval and the root cause of recent pricing increases, product shortages, and more.

In this installment, we explore supply chain challenges and insights for the Paper and Multi-Function Devices (MFD) industries.

Supply Chain Challenges and Insights: Paper and MFD

Updated: November 22, 2022

Working alongside our supplier partners for Fine Copy Paper on OECM’s Office Supplies and Fine Copy Paper agreement, as well as our Office and Production Multi-Function Devices and Related Services (MFD) agreement, we’ve gathered specific examples of supply chain challenges, resulting impacts, anticipated outcomes and related industry insights.

The following is a summary of what we have heard:

PAPER

Facility Closures

Supply Chain Disruptions and/or Challenges: Major Canadian paper mill closures severely impacted the paper supply in Canada.

Industry Insights & Trends Forecast: Due to limited inventory, suppliers are encouraging customers to determine and communicate details on their anticipated order in advance (e.g., provide an annual forecast) to ensure inventory can be secured.

Supplier/Customer Impact: Back Order, Limited Inventory

Shifting Priorities

Supply Chain Disruptions and/or Challenges: Paper mills have shifted production focus from paper to the more profitable cardboard and corrugate which is now in high demand due to increased shipping volumes (i.e., online shopping, personal deliveries, etc.)

Industry Insights & Trends Forecast: Production focus shift (from corrugate/cardboard to paper) will depend on customer demand, however, as this is difficult to predict, it is important that customers forecast and communicate their upcoming paper requirements with suppliers.

Supplier/Customer Impact: Back Order, Limited Inventory

Fluctuating Demands

Supply Chain Disruptions and/or Challenges: Paper manufacturers, such as Domtar, are focusing on producing white paper over coloured/specialty papers due to a higher-than-average demand for white paper.

Industry Insights & Trends Forecast: Though this was initially expected to be resolved quickly, it continues to pose a challenge. OECM suppliers are working to identify alternate coloured paper manufacturers for future orders.

Supplier/Customer Impact: Back Order, Limited Inventory

Allocation Restrictions

Supply Chain Disruptions and/or Challenges: Suppliers provide forecasts to their manufacturers and receive allocations accordingly. Consequently, suppliers are finding it difficult to accept large orders that need to be shipped urgently due to their allocation restrictions.

Industry Insights & Trends Forecast: Customer pre-planning (i.e., forecasting) and collaboration with suppliers will be necessary moving forward to ensure that suppliers are able to accurately forecast for allocation to manufacturers.

Supplier/Customer Impact: Back Order, Limited Inventory

Resource Constraints

Supply Chain Disruptions and/or Challenges: The industry is experiencing many resource constraints, including, for example, driver shortages.

Industry Insights & Trends Forecast: Suppliers are addressing these constraints by:

- Extending freight lead time

- Monitoring shipping conditions more frequently

- Leveraging manufacturing partners in North America

Supplier/Customer Impact: Back Order, Increased Pricing

Increased Transportation Costs

Supply Chain Disruptions and/or Challenges: Increased gas prices, packaging and labour costs continue to make an impact.

Industry Insights & Trends Forecast: According to experts, inflationary pressure driven by strong demand and tight capacity in freight markets is likely to persist in 2022. Price increases are expected to moderate in 2023, as transportation demand eases and companies finish replenishing depleted inventories.

Supplier/Customer Impact: Back Order, Increased Pricing

Price Fluctuations

Supply Chain Disruptions and/or Challenges: Increases in the cost of raw materials and unexpected price fluctuations across categories continue to make an impact.

The price increase percentage and frequency passed on to supplier partners from their manufacturers and OEMs are also highly unpredictable.

Industry Insights & Trends Forecast: It is expected that market volatility and unpredictability will continue to be a challenge for the foreseeable future.

Supplier/Customer Impact: Increased Pricing, Unprecedented Cost Increases

MULTI-FUNCTION DEVICES (MFD)

Increased Global Logistics Costs

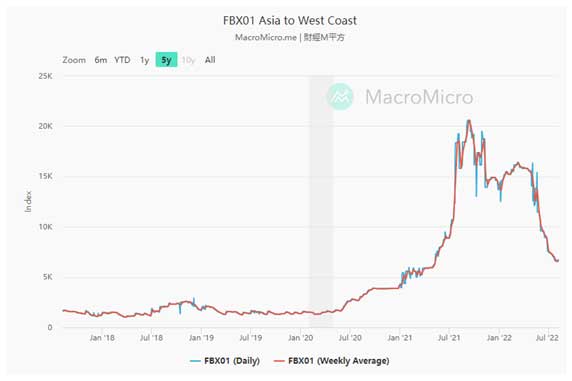

Supply Chain Disruptions and/or Challenges: Most MFDs are manufactured and shipped from China and East Asia to the Port of Vancouver, BC. Between July 1, 2020, and December 31, 2021, the weekly average cost to ship a 40-foot container increased by 241%. (MacroMicro, FBX, Freightos Baltic Index)

Trader’s Insight – Industries: Maritime Shipping. “FBX01 Asia to West Coast”. MacroMicro.me, 2022, https://en.macromicro.me/collections/4356/freight/35159/fbx01-china-east-asia-to-north-america-west-coast. Accessed 12 September 2022.

Industry Insights & Trends Forecast: The weekly average cost to ship a 40-foot container has been decreasing steadily since April 15, 2022.

Supplier/Customer Impact: Increased Pricing

Increased Local Transportation Costs & Labour Shortages

Supply Chain Disruptions and/or Challenges: Local transportation costs for some suppliers have increased by 200% since September 2021. As well, ongoing driver shortages, exacerbated by the pandemic and a declining labour force participation rate, continue to make a significant impact.

Industry Insights & Trends Forecast: Industry representatives from the Canadian Trucking Alliance predict continued driver shortages into 2023; recommend training programs to help the industry meet the demands of the supply chain.

Supplier/Customer Impact: Increased Pricing

Increased Component Costs

Supply Chain Disruptions and/or Challenges: Due to increased demand, component costs, specifically computer chips and integrated circuit boards, have been steadily increasing. Chip shortages continue to be a challenge as well.

Industry Insights & Trends Forecast: According to a Deloitte analysis, the global semiconductor shortage has resulted in a loss of US$500 billion in sales over the past two years. Chip shortages are expected to continue in 2023 and beyond, with continued pressure on technology products causing constrained availability and longer delivery times.

Supplier/Customer Impact: Increased Pricing

Inflation and Increasing Interest Rates

Supply Chain Disruptions and/or Challenges: Canadian interest rates have increased drastically since September 2021, contributing to increased pricing. Inflation is on the rise; in March 2022, Canada experienced its biggest increase in inflation in more than three decades.

Industry Insights & Trends Forecast: Some suppliers foresee their cost of funds for leasing the equipment (MFDs) will continue to increase in the year ahead, thereby increasing their losses. According to Statistics Canada, inflation rates are expected to move even higher in the near term before beginning to ease.

Supplier/Customer Impact: Increased Pricing

How is OECM’s SRM team working with Supplier Partners to Address these Impacts?

To help you navigate these challenging times, OECM’s dedicated Customer Relationship Management (CRM) and Supplier Relationship Management (SRM) teams continue to work behind the scenes gathering, analyzing, and sharing relevant supplier partner updates and information. Furthermore, our SRM team members keep an eye on market fluctuations, research and report on industry trends, collaborate with OECM suppliers to better understand the disruptions they are facing and negotiate pricing to help minimize the impact on your organization. Ultimately, OECM’s goal is to provide information that will offer support and assistance as you source the products and services your organization needs to ensure optimal function and continued success.

OECM’s SRM team keeps a close eye on OECM agreements as each one has its own price refresh timelines. During these times the SRM team works towards mitigating the impact on our customers. The team compares industry benchmarks (e.g., CPI – consumer price index, CSPI – commercial software price index, etc.) and uses historical spending data, which reflects customer purchase history, to analyze the impact of any proposed price increases. Analysis of impact on product/service pricing is a way to strategize the negotiations with suppliers to ensure the impact is minimized. Price refresh requests are not carried out without supporting documents/OEM notifications and the SRM team does due diligence in ensuring the reasoning and rationale provided are a true reflection of the existing market condition.

What can OECM Customers do to Mitigate these Impacts?

Collaboration and teamwork

Working closely with OECM and supplier partners is your first line of defence as you navigate market uncertainties. In a recent whitepaper titled Six key trends impacting global supply chains in 2022, KPMG noted that organizations “should focus on building a network of trusted vendors (customers, supply chain partners, and suppliers) to help manage disruptions and support business continuity. Cultivating a resilient supply chain means that the organization can be better at anticipating, reacting and planning against the unexpected by enabling cross-functional integration and collaboration with its ecosystem of vendors.”

Advanced planning and open communication

OECM’s suppliers agree that pre-planning will be a necessary approach moving forward, particularly during these unprecedented times. Suppliers recommend that customers aim to plan their purchases well in advance and communicate the expected purchase and requirements (including details such as bulk/one-time purchase, number/type of delivery points, product details, and expected delivery time, for example) with suppliers as soon as possible.

Supply Chain Disruptions: What’s the outlook?

Based on the feedback gathered and research conducted by OECM’s SRM team, at this stage, industry experts generally agree that it will get worse before it gets better. For example, in their June 2022 Paper Trader report, Fastmarkets RISI, noted that it expects, “at least one more modest tick up for prices in 2022” and that “non-integrated producers will likely feel the need to pass extremely heavy energy and pulp cost inflation on to buyers.” As well, RISI shared that “importers continue to struggle with energy and ocean freight costs, preventing offshore suppliers from easing the domestic supply/demand imbalance.”

And, according to the Organisation for Economic Co-operation and Development (OECD) in their Economic Canada Snapshot published in June 2022, “supply-chain disruptions have slowed but not arrested Canada’s economic recovery.” Furthermore, the OECD states that high inflation is strictly related to supply chain disruptions; “more persistent supply constraints could, however, mean that inflation stays higher for longer and delays any projected acceleration in trade and consumer spending.”

As we head into 2023, OECM will continue to facilitate opportunities for collaboration, transparency, and the timely exchange of information between suppliers and customers to help identify and combat long-term supply chain challenges and impacts versus those that are only temporary.

If you have any questions, please contact our Customer Support team at:

OECM Customer Support

1-844-OECM-900 (1-844-632-6900)

Check out OECM’s Industry Spotlight: Focus on Cybersecurity for more great supplier partner insights.